What Is The 2025 Gift Tax Exclusion Amount - It is essential to continue paying your premiums on time to maintain the policy’s active status. Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per.

It is essential to continue paying your premiums on time to maintain the policy’s active status.

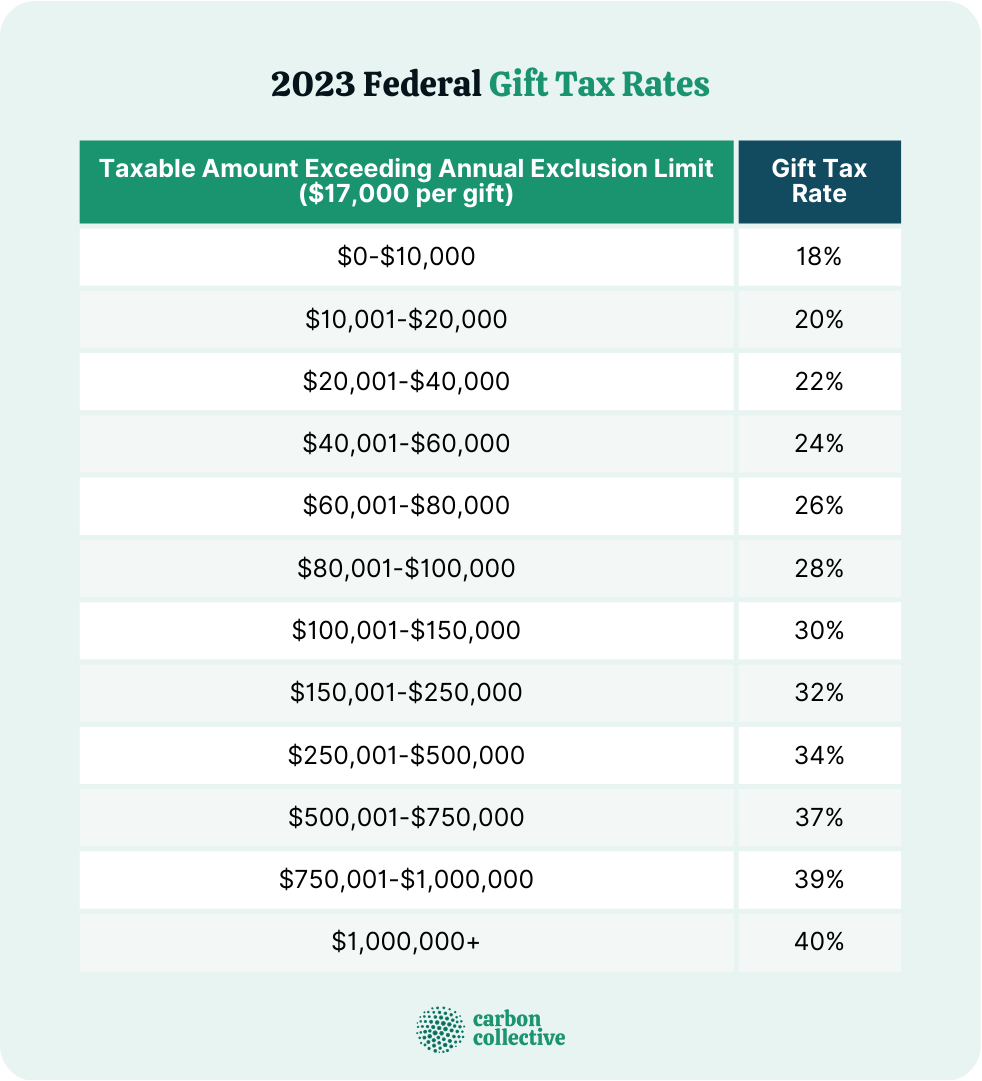

Irs Gift Exclusion 2025 Fiann Annabell, The combined gift and estate tax exemption will be $13.61 million per individual for lifetime. For 2025, the annual gift tax limit is $18,000.

Gift Tax Annual Exclusion 2025 Katya Melamie, In addition, the estate and gift tax exemption. For example, a man could.

This means you can give up to $18,000 to as many people as you like without any gift tax.

2025 Gift Tax Exemption Amount Bren Steffane, It is essential to continue paying your premiums on time to maintain the policy's active status. 2025 annual gift tax exclusion amount.

Lifetime Gift Tax Exclusion 2025 Irs Form Astrid Eulalie, In 2025, the annual gift tax exclusion amount is $18,000 per recipient. This means you can give up to $18,000 to as many people as you like without any gift tax.

Annual Gift Tax Exclusion 2025 Irs Nike Sabrina, In addition, the estate and gift tax exemption. Increase to boost consumption and economic.

What Is The 2025 Gift Tax Exclusion Amount. It is essential to continue paying your premiums on time to maintain the policy's active status. Standard deduction increase expected in budget 2025.

Lifetime Gift Tax Exclusion 2025 Willi Odilia, 2025 annual gift tax exclusion amount. For example, a man could.

The basic exclusion amount for determining the amount of the unified credit against estate tax under irc section 2010 will be $13,610,000 for decedents who die in 2025, a. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on.

The 2025 Estate & Gift Tax Exemption Amount Set to Rise Again Geiger, The annual gift tax exclusion will be $18,000 per recipient for 2025. 2025 annual gift tax exclusion amount.

In 2025, the annual gift tax exclusion amount is $18,000 per recipient.

2025 Updated Estate & Gift Tax Numbers Makofsky Valente Law Group, P.C., The income tax act states that gifts whose value. In 2025, the annual gift tax exclusion amount is $18,000 per recipient.

Annual Gift Amount 2025 Rania Catarina, The annual exclusion applies to gifts of $18,000 to each donee or recipient per. In general, the gift tax and estate tax provisions apply a unified rate schedule to a person’s cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, You can get hra exemption on the lowest amount amidst. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for.